Classification Checklist

For companies hiring more than 100 freelancers, misclassification is a mistake that can bankrupt you.

While classification rules and implications vary regionally, the main impact is back taxes or lawsuits.

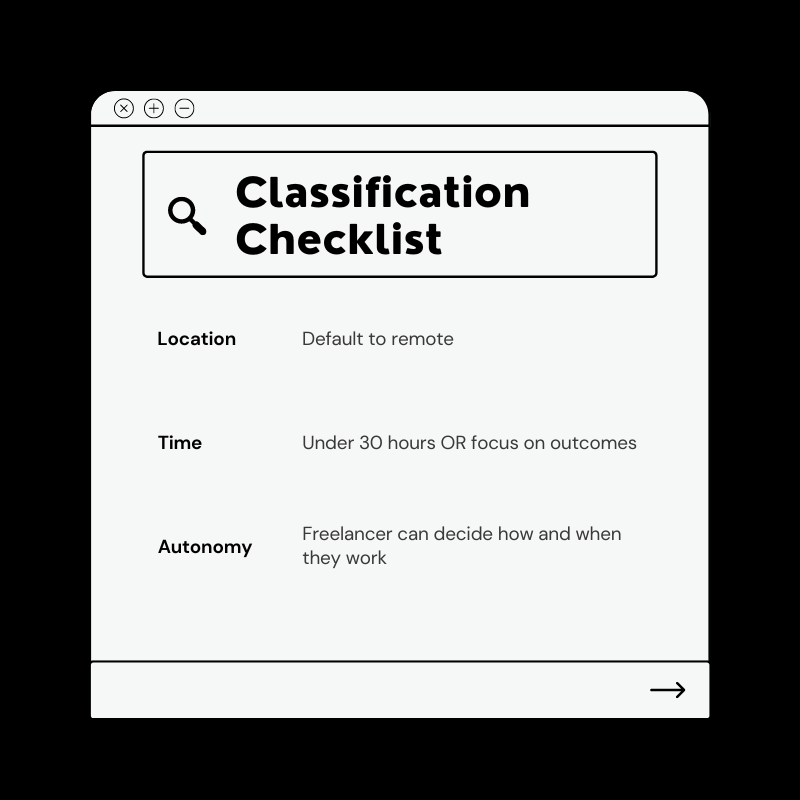

Classification is as simple as, “should this person be a full time employee (W2) or independent contractor (1099)”. Countries, and even states like California, have different rules and tests to determine.

If on the wrong side, you can owe years of back taxes, or class action lawsuits like Microsoft’s $97m ‘permatemp’ case.

DISCLAIMER: This is not legal advice. Classification is ever-changing, and this does not replace advice from employment lawyers.

Join fellow industry leaders and subscribe to the freelance focus

Tagged checklist