FULL ACCESS

Q1, '24, Human Cloud Freelance Trend Tracker

Table of Contents

Leaders, this is still in beta. We can’t thank you enough for helping us build this quarterly database that we can all benefit from, rally around, and use to move our businesses forward.

Please don’t hesitate to reach out, tell us what works, what doesn’t, and how we can be better. You can always reach me at [email protected]

Thank you so much for your support.

Jon and Matt

Download

How To Use Trend Tracker

1: Inform your roadmaps, your sales and marketing strategy.

2: Use (copy/paste) the charts and data across your collateral, you have a royalty free license so long as there is “Human Cloud” attribution.

3: Use this as an in to educate your clients. Host a workshop. Discuss our referral program to give them special access.

High Level Learnings

Key Takeaways

*bold = discussion points

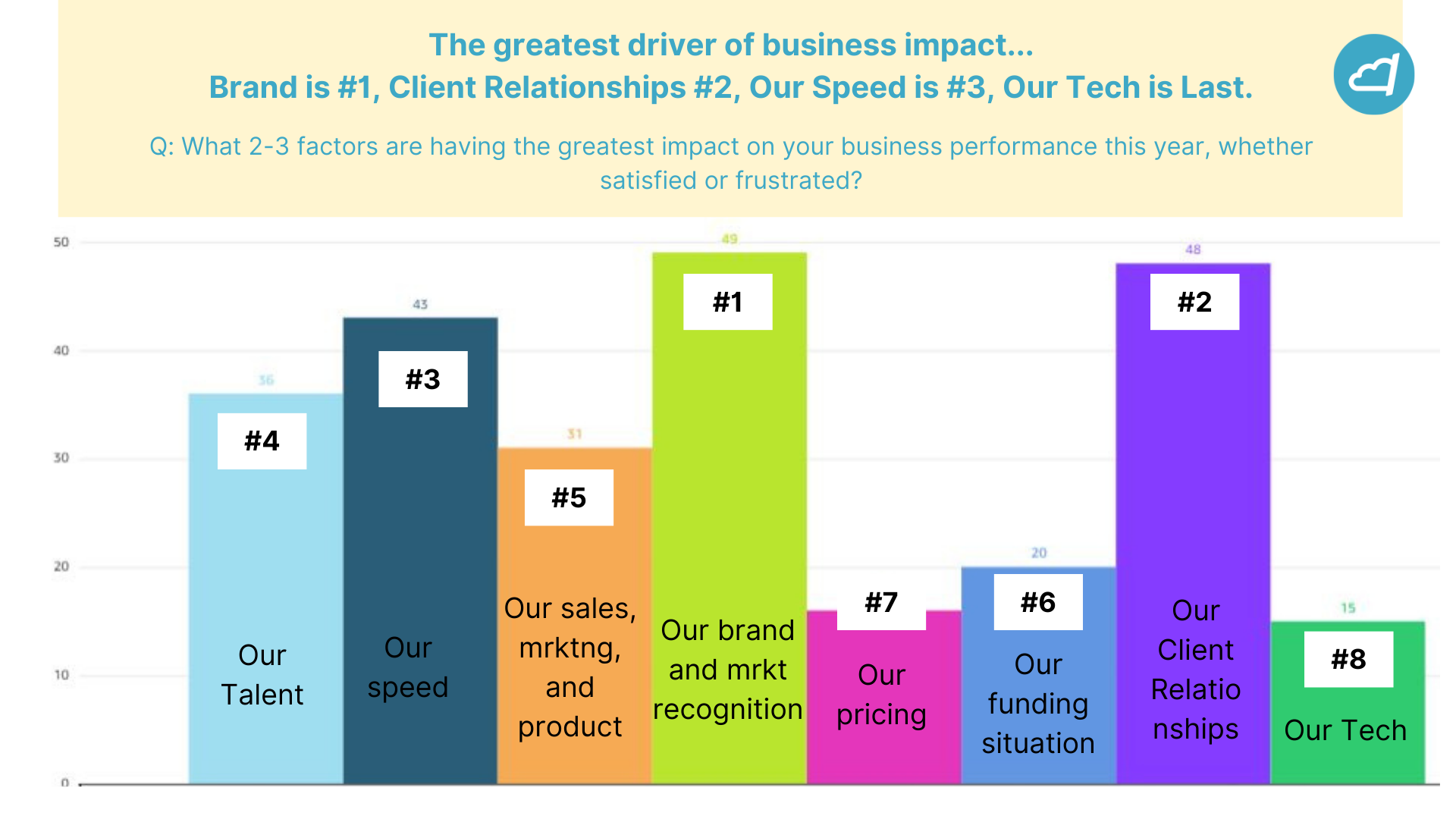

- Brand recognition is key, as it’s the leading driver of impact, which means you need to be the first person clients think of, yet how do you build brand in today’s tight, low budget, cash strapped environment? What activities are low cost, high impact? What unfair positioning do you have to build brand?

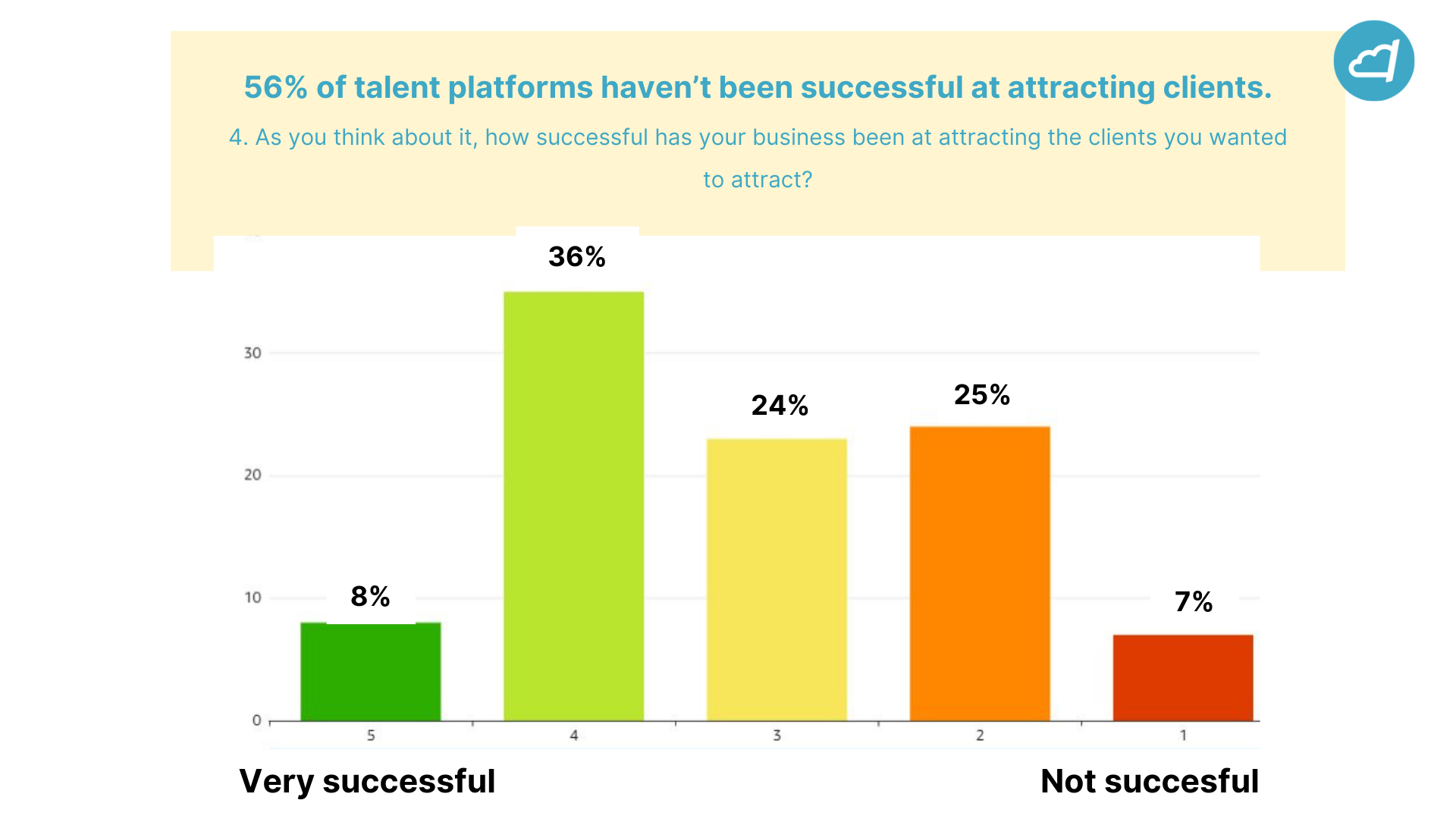

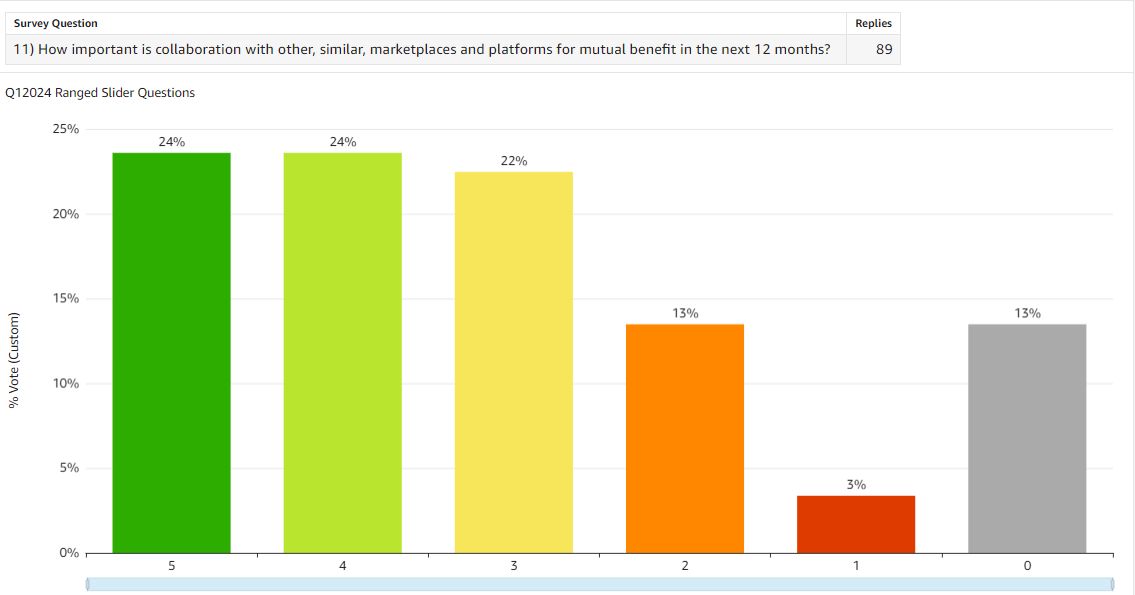

- Partnerships are key, as internal teams aren’t enough (56% not successful at attracting clients), yet platform-to-platform partnerships look to compensate. Platforms realize this, and the ROI is becoming clear, as 54% are prioritizing partnerships, and one client saw a 35% jump in revenue directly from a platform partnership. How are you building sustainable partnerships?

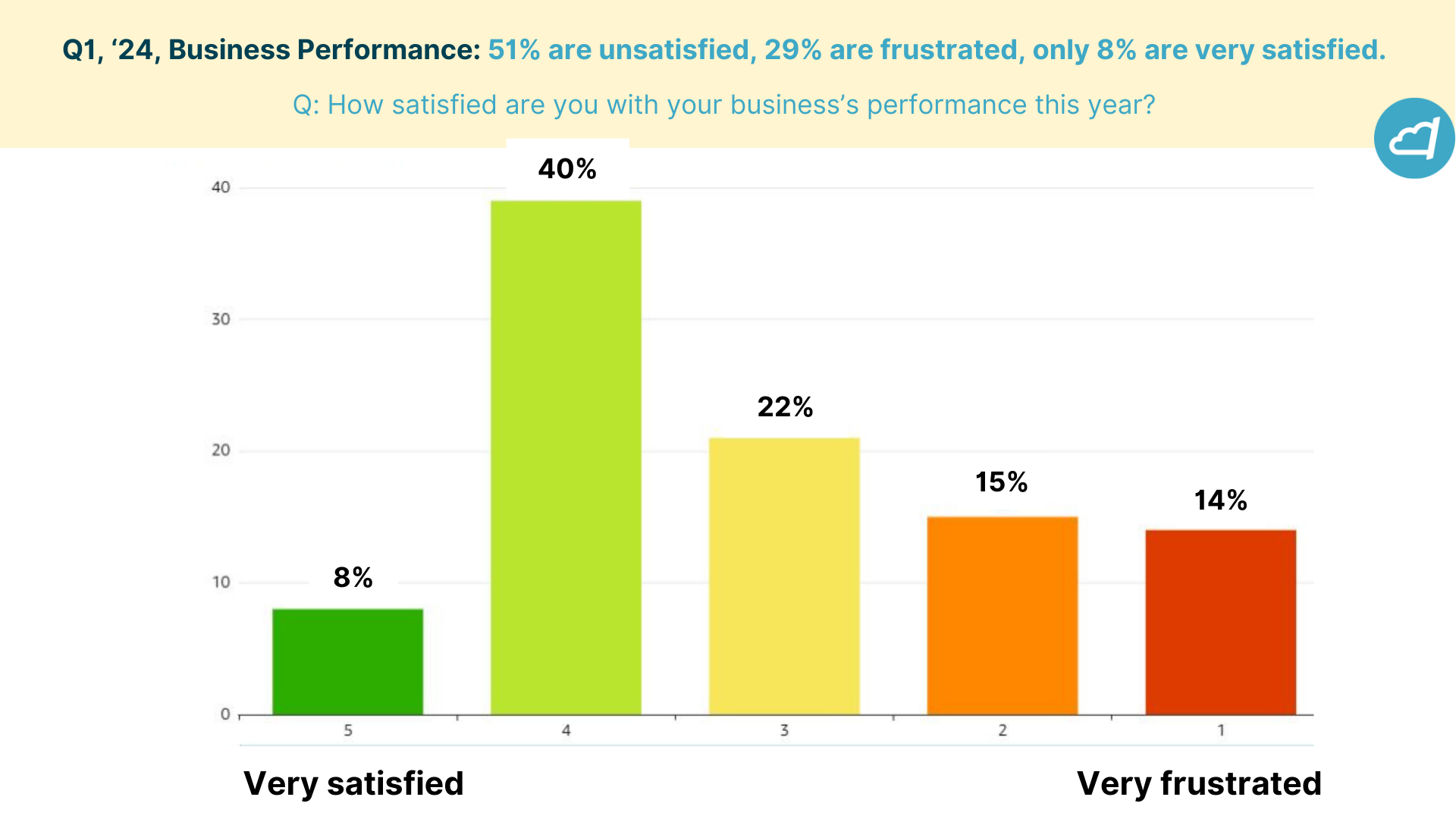

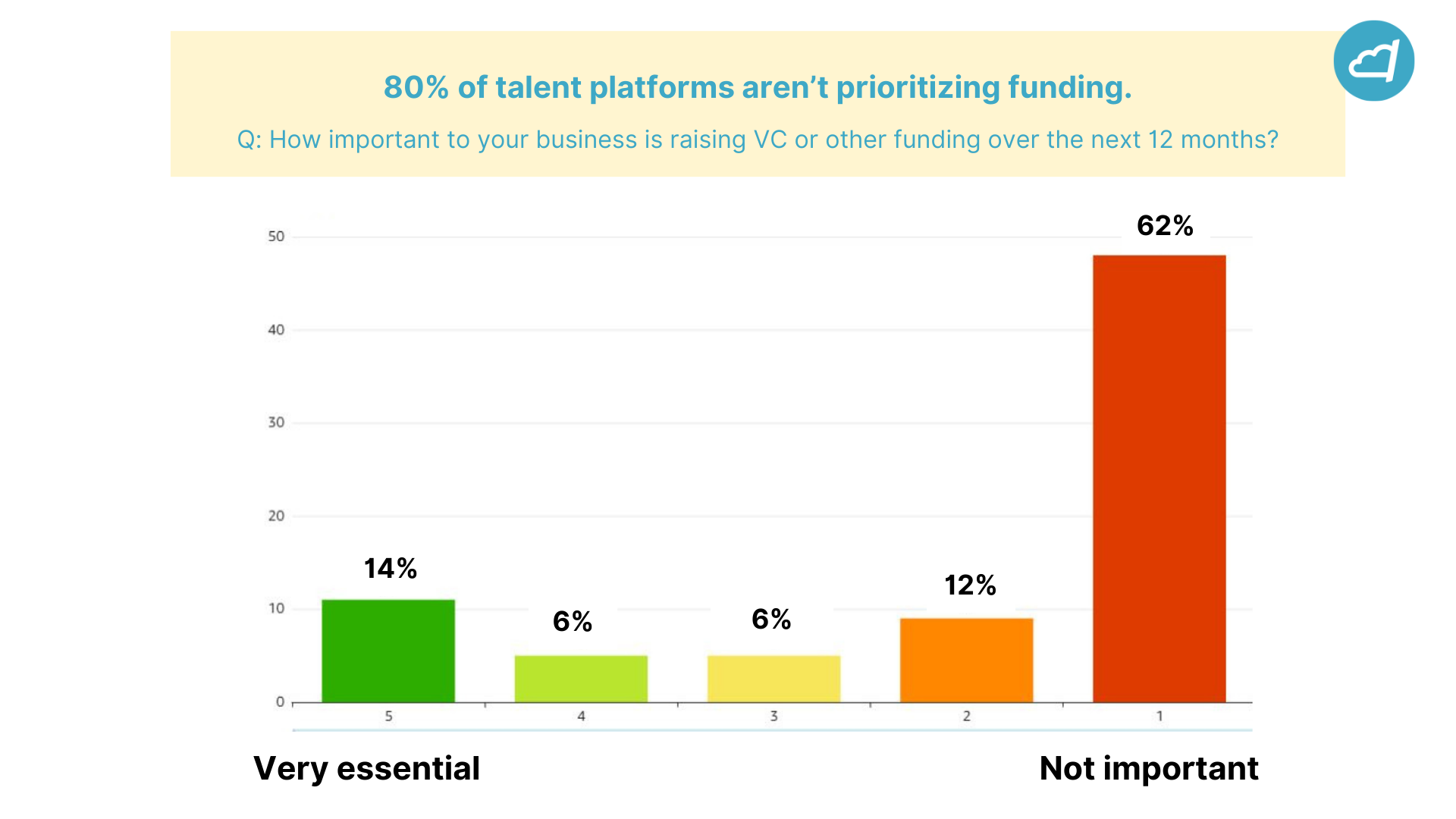

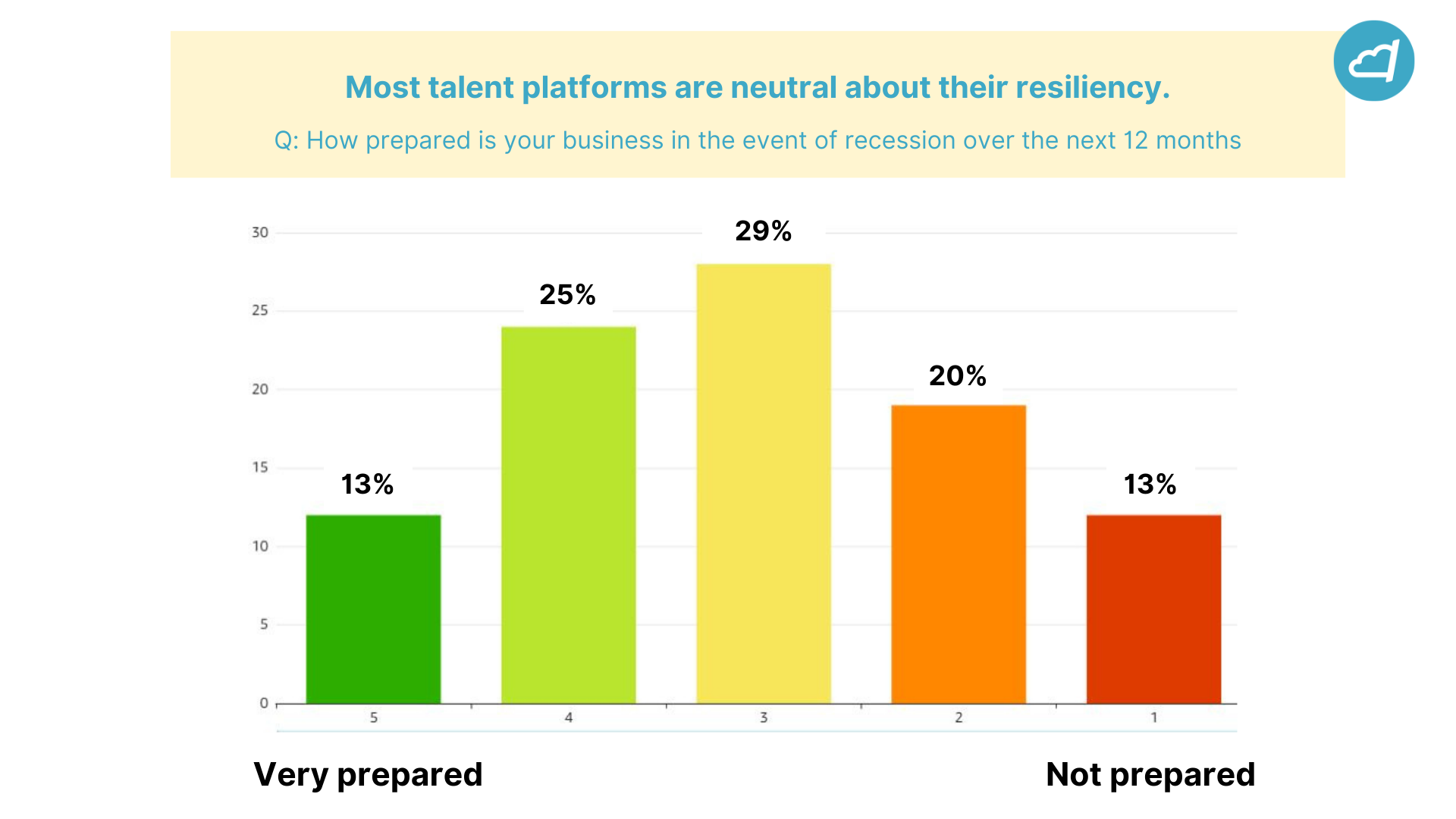

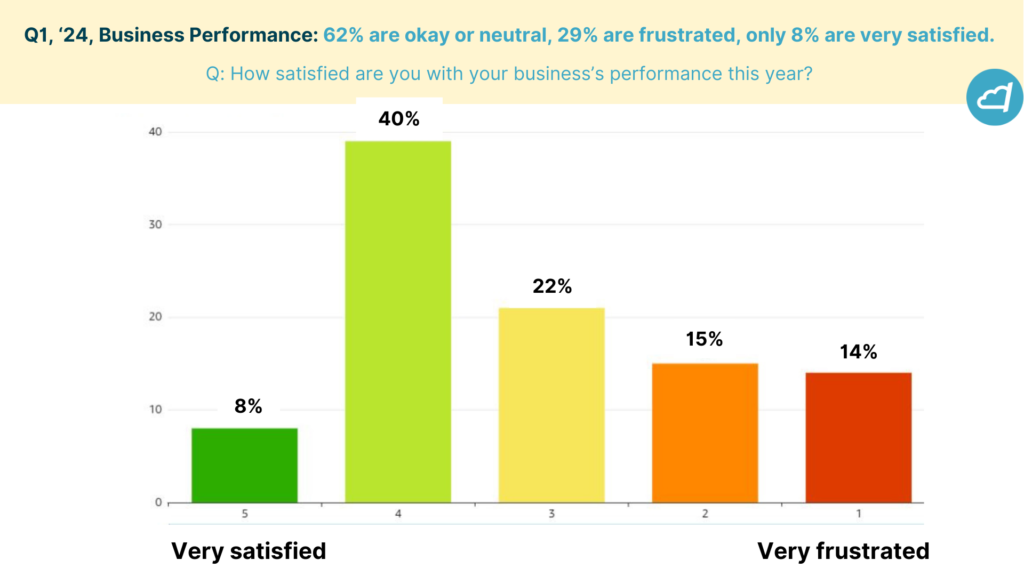

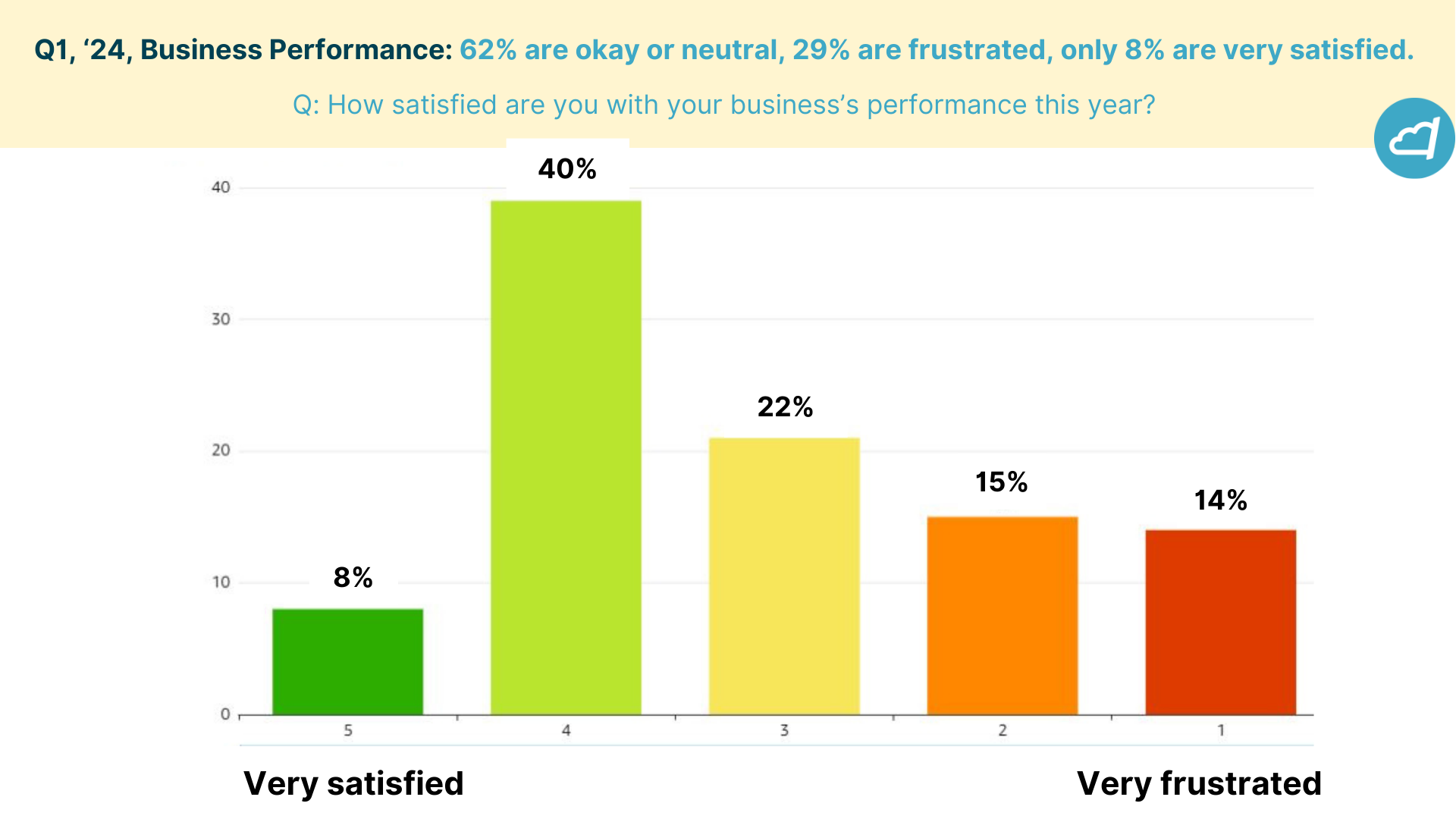

- Resilience is crucial, as performance is still mediocre, and venture funding is still poor. How do you balance brand, client expansion, and consolidation when you need profitability, agility, and resiliency?

- Most platforms aren’t resilient, potentially leading to increased consolidation, as it’s a buyers market, since there is a significant amount of platforms that believe they can succeed, believe they have the right team, yet haven’t performed, nor are very prepared to perform in today’s economy. Are you ready, structured right, and attractive for an acquisition?

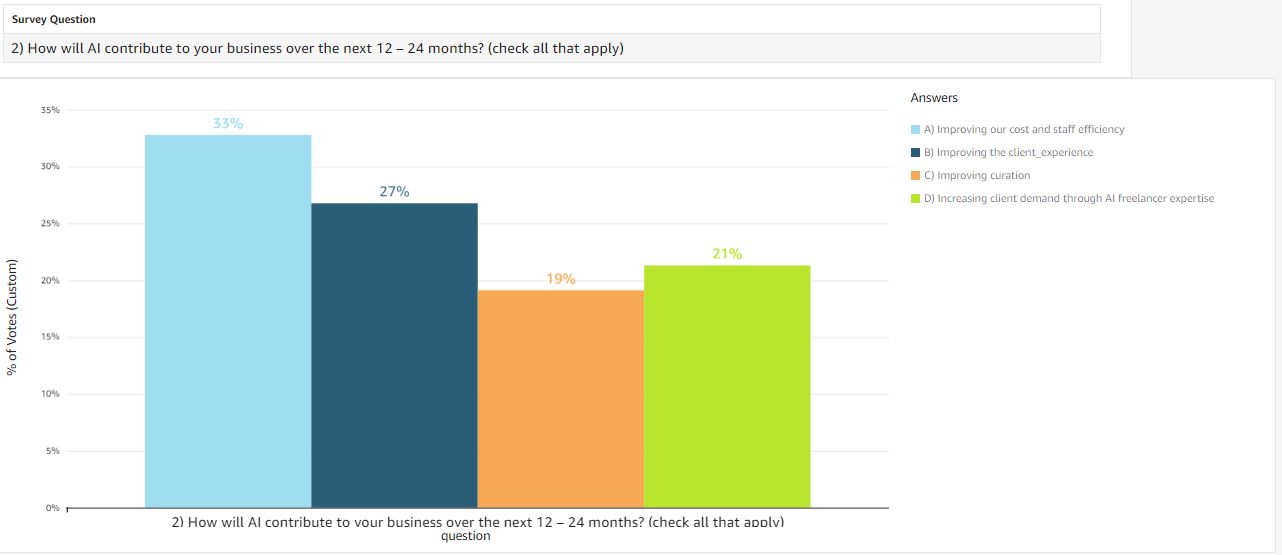

- AI is supportive, mostly improving cost and staff efficiency, along with the client experience, but not really curation. Is this because platforms don’t have the internal expertise? Or because the technology isn’t ready? Can private equity capitalize on this?

- With AI, the higher the strategy, and nuance, the more demand, and higher hourly rate, and vice versa. This is consistent with last quarter. Are you strategy heavy, and transactional light?

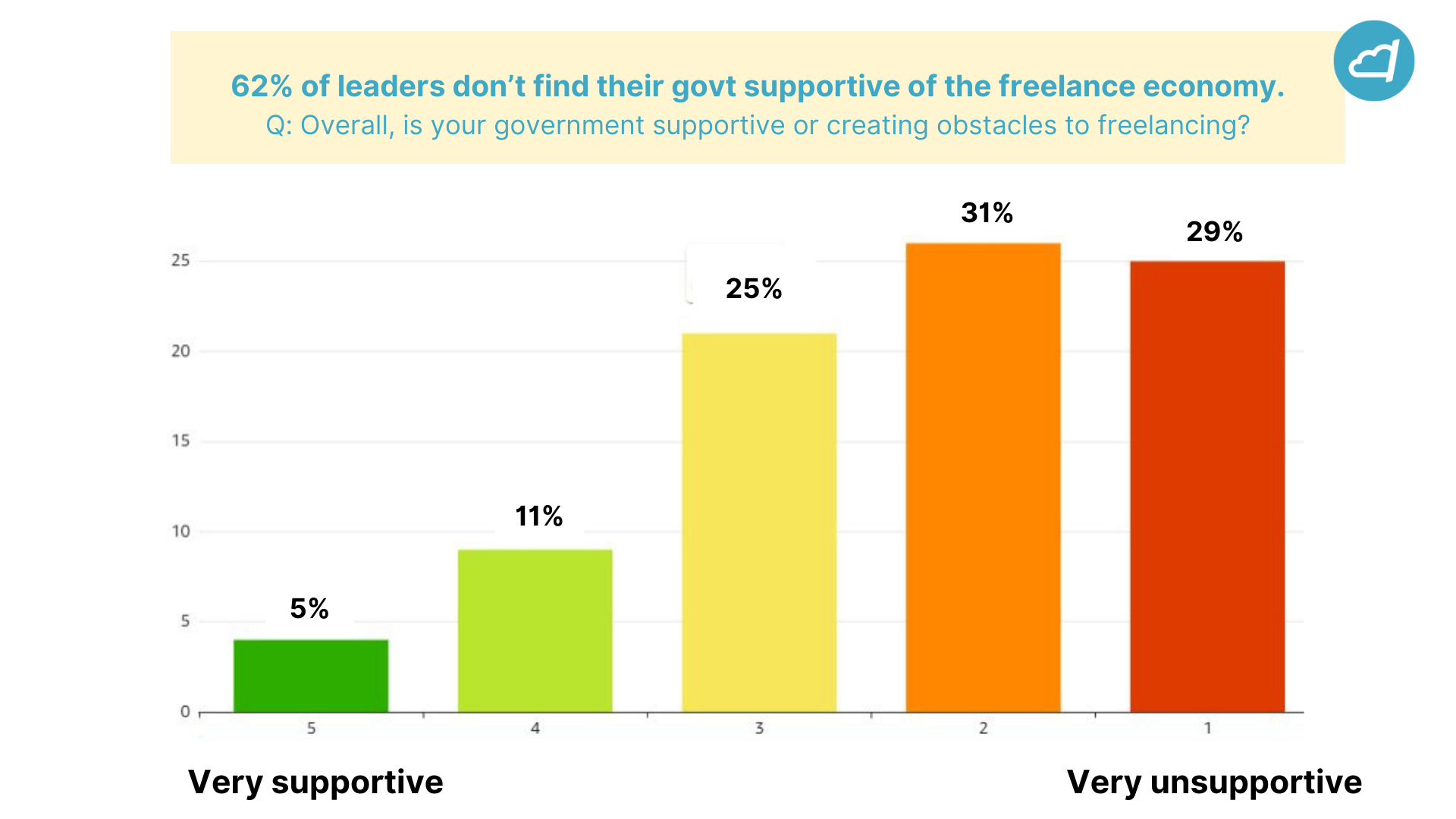

- Compliance isn’t going anywhere. As 62% of leaders don’t find their govt supportive of the freelance economy, politics will only get more polarized, Enterprise Procurement, HR, and Legal leaders will deem freelance riskier, and misclassification will only get more confusing globally and more prone to politics. What is your compliance strategy? Do you have a robust compliance partner? Do you have a robust talk track, terms, and plan for navigating client compliance?

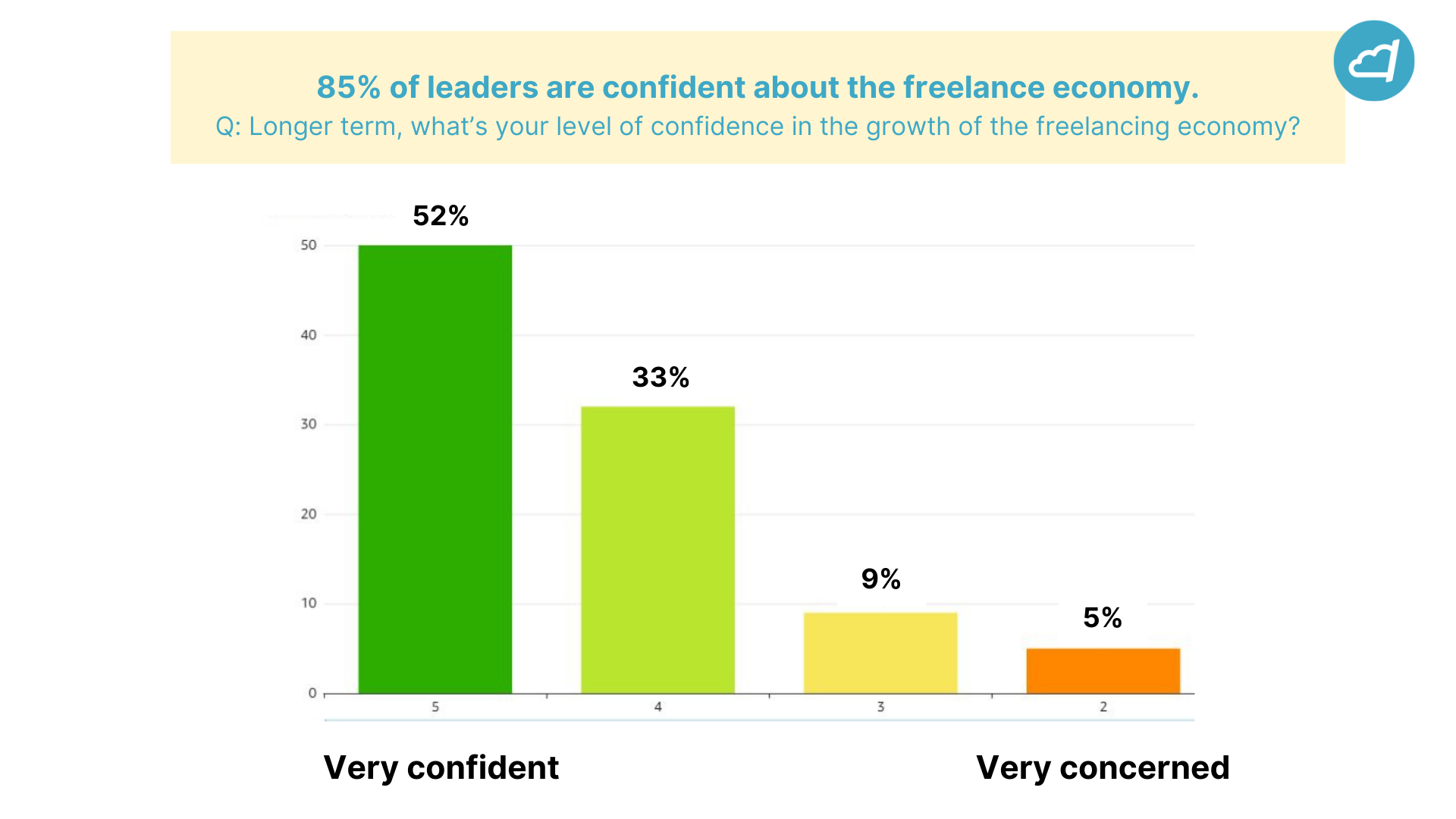

- 4% drop in Freelance Leader confidence. Why?

Downloadable Presentation

This is the full presentation with analysis of the Q1, ’24 results.

*We are constantly updating based off your feedback. Please comment directly in the document below, or email us at [email protected]

Prior Trend Tracker Results

Public, Q3, ’24, Human Cloud Freelance Trend Tracker

Sentiments of global freelance economy leaders in Q3, 2024. The Human Cloud Freelance Trend Tracker tracks the global sentiment of freelance platforms, providers, and applications. If the supply side or customer is a freelancer, Trend Tracker tracks the performance and provides prescriptive guidance for executive teams to plan, prioritize, and invest strategically.

Q1, ’24, Human Cloud Freelance Trend Tracker

Sentiments of global freelance economy leaders in Q1, 2024. Brand recognition takes over as leading driver of business impact, while platform partnerships prove promising, and is consolidation coming? The signals are here.

Human Cloud: Q4, ’23, Freelance Trend Tracker

Sentiments of global freelance economy leaders in Q4, 2023.