Q3, '24, Human Cloud Freelance Trend Tracker

The Human Cloud Freelance Trend Tracker tracks the global sentiment of freelance platforms, providers, and applications. If the supply side or customer is a freelancer, Trend Tracker tracks the performance and provides prescriptive guidance for executive teams to plan, prioritize, and invest strategically.

Public Preview

This is a public preview. To see all aggregated stats on the freelance economy, purchase a Human Cloud subscription.

Table of Contents

about

This report is compiled by the Human Cloud research team. Human Cloud uses a proprietary knowledge graph that aggregates all relevant data, continuously acquires first party data (Trend Tracker Survey), and analyzes this data for the application of leaders driving freelance adoption.

How to use this: Use this to prioritize your plan, roadmap, and investments for Q4 and 2025.

Related Resources: Industry Landscape, Stat Aggregator, Podcast, Presentation Hub

Audience: Freelance Platforms, Providers, and Applications

What We Recommend

Steps you should take asap.

- Overall, now is the time to win market share. Not necessarily freelance market share, since the industry is still too young to have dedicated market share, but market share of your existing industry. If you’re a marketing platform, win market share against marketing agencies.

- Primary investment priority is sales, with events and relationship activities as the foremost line item. This doesn’t mean sponsoring every event. This means having a presence at events, nurturing your first and secondary relationships, and prioritizing light sales and marketing activities over large investments.

- Second investment priority is partnerships, with platform to platform partnerships as the leading priority, industry related partnerships as the second priority, and traditional contingent talent providers as the third priority.

- For example, sponsoring reports with fellow platforms, sponsoring events with fellow platforms or industry peers, etc

- Third investment priority is thought leadership.

- Plan for failure, specifically invest in what you can afford to not work. For example, don’t spend $30,000 to sponsor a conference if you can’t afford to $30,000. Instead, invest $3,000 in going there and trying to create meetings. Likewise, don’t invest $500,000 into a technology platform, if project managers can plug the hole and provide the exact technical requirements needed.

- Be ready for an acquisition. Don’t waste time overanalyzing or perfecting investment decks. But be ready to know who would acquire you, and what the key value propositions for an acquisition would be.

- Think long term, and assume you need to be cash flow positive. Investment is still slow. There is money, but in most cases it’s not worth prioritizing potential investment versus profitability.

- Plan as if SEO might be dead.There are multiple reasons, with the overwhelming reason that SEO works well if you’re the largest, and customers know what they want, and are searching keywords that describe you. In most cases, our industry is too immature for keywords to work. Instead, the best platforms are able to match their customers’ pain points and use cases, which unfortunately seems to be beyond any SEO/SEM solution. Caveat – we don’t know the science of marketing, and I’m sure there are marketing experts that would disagree with this. We are going purely by what the best platforms are doing and investing in.

Key Stats

- 85-90% of freelance leaders are confident about the long term growth of the freelance economy, even amidst headwinds with business performance, client acquisition, external funding, and government support. For example, 31% of leaders say they are satisfied with client acquisition, with only 6% being very satisfied (Trend Tracker).

- 90% of business leaders believe that talent platforms will be somewhat or very important to their organization’s future competitive advantage (HBS, Building The On Demand Workforce).

- 70% of GenZ are currently freelancing or plan to in the future, and 53% of Gen Zers work full-time hours on freelance projects (Fiverr), while 45% of US millennials freelance (Statista).

What We’ve Heard

- Q2 and Q3 were tough, and may have been the bottom. May in particular was tough.

- Companies have held tight. On the whole, they haven’t pushed back or detracted spend. Rather, they have maintained, not investing or prioritizing freelance. For some, this has meant 15-30% growth with companies where the relationships are strong, success has been proven and well measured, the infrastructure/workflows are established, and the change management was low.

- VMS and MSP’s are interested in freelance, but…

What We’ve Seen

A compilation of updates we’ve seen across the industry.

- The “AI hype” is unfounded yet the noise is high. Large traditional platforms like Upwork and Fiverr highly touted AI interest on their platforms. We’re actively monitoring but can’t report if this interest has converted into sustainable adoption (sustainable meaning repeat projects/engagements/hiring).

- Innovation is happening at the go to market and business model level. For example, working directly with your industry’s existing agencies or consultancies are showing strong promise. Likewise, subscription versus transactional business models are showing promise.

- Partnership is high, foremost among platforms to platforms, secondarily amongst platforms to VMS/MSP’s.

- Traditional large players seem to be…

Want to access the full report?

This is a public preview. To see all aggregated stats on the freelance economy, purchase a Human Cloud subscription.

Prior Trend Tracker Results

Public, Q3, ’24, Human Cloud Freelance Trend Tracker

Sentiments of global freelance economy leaders in Q3, 2024. The Human Cloud Freelance Trend Tracker tracks the global sentiment of freelance platforms, providers, and applications. If the supply side or customer is a freelancer, Trend Tracker tracks the performance and provides prescriptive guidance for executive teams to plan, prioritize, and invest strategically.

Q1, ’24, Human Cloud Freelance Trend Tracker

Sentiments of global freelance economy leaders in Q1, 2024. Brand recognition takes over as leading driver of business impact, while platform partnerships prove promising, and is consolidation coming? The signals are here.

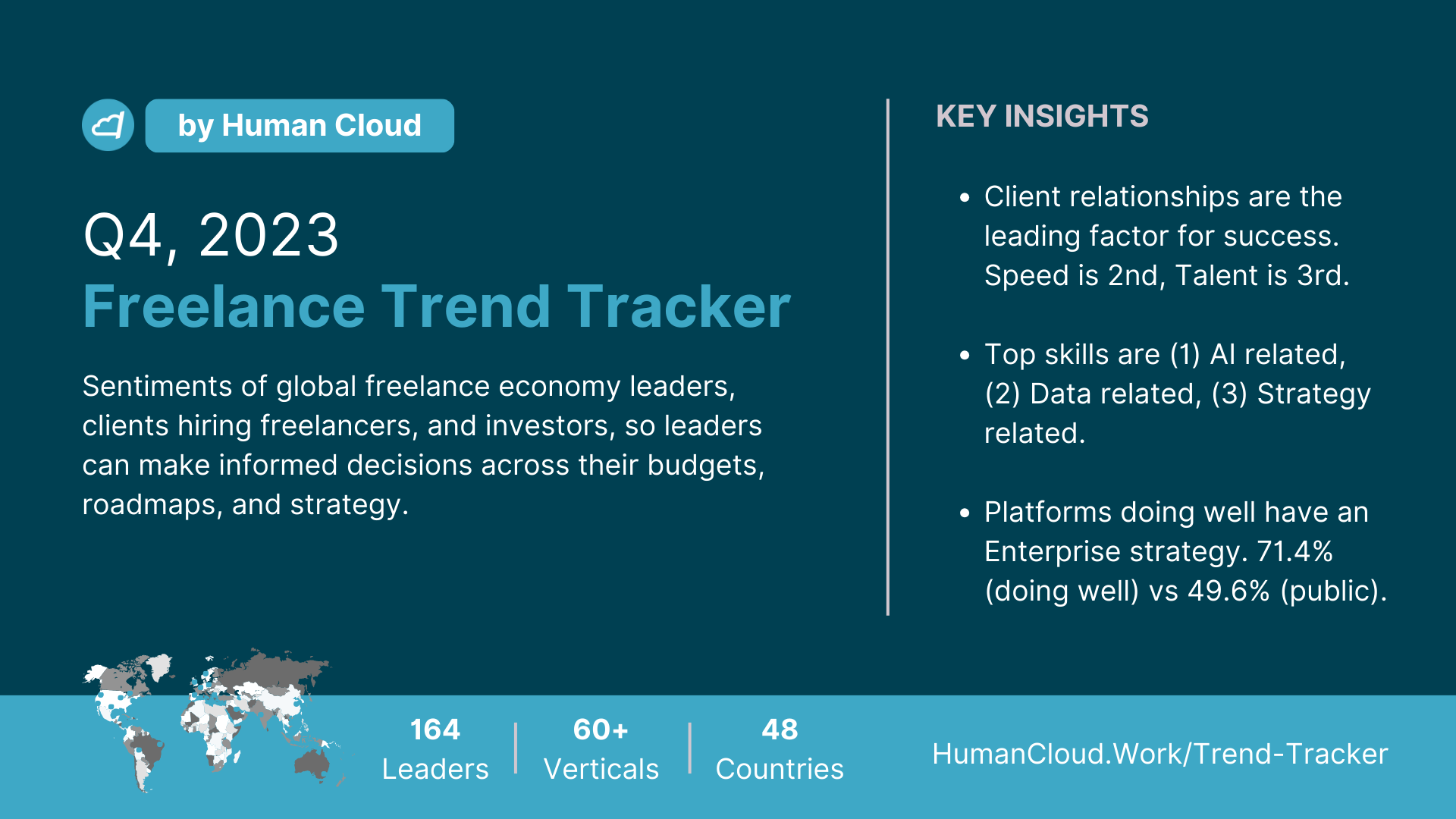

Human Cloud: Q4, ’23, Freelance Trend Tracker

Sentiments of global freelance economy leaders in Q4, 2023.

Want to access the full report?

This is a public preview. To see all aggregated stats on the freelance economy, purchase a Human Cloud subscription.